The Group operates two business segments, Ports and Shipping. A third segment, Marine Support Services, was operated by the Group until its disposal on 23 July 2020.

Overview

Ports

Ports

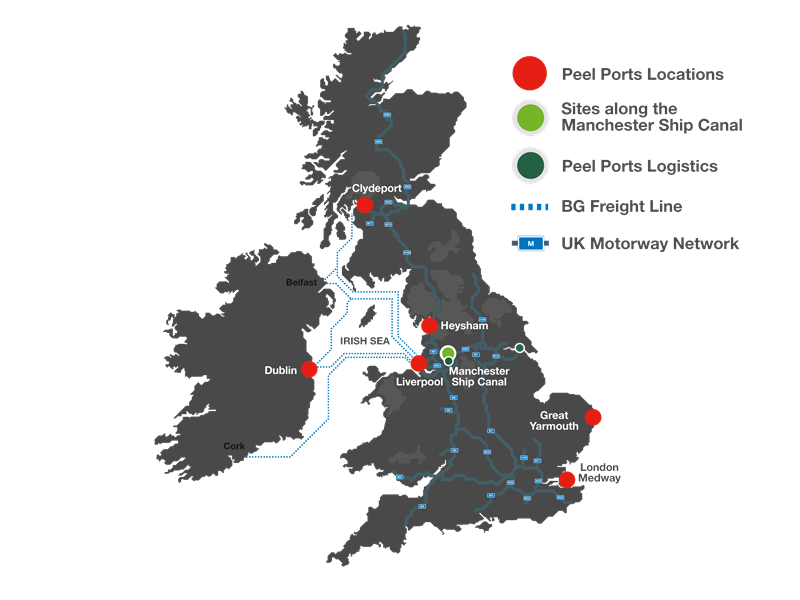

Peel Ports Group Limited and its subsidiaries (“the Group”) operate as the Statutory Harbour Authority for the Port of Liverpool, the Manchester Ship Canal, the River Medway, parts of the area along and around the River Clyde, Ardrossan Harbour, Twelve Quays at Birkenhead Docks and Heysham Port.

In addition, the Group operates Great Yarmouth Port as an agent of Great Yarmouth Port Authority, the Statutory Harbour Authority for that port, on a long-term basis.

Container facilities, freight forwarding and cargo handling services are also provided at Dublin Port under concession.

The Group’s assets form a strategic hub centred on the Irish Sea, with locations in Liverpool, Dublin, Glasgow and along the Manchester Ship Canal. Linked by the Group’s short sea shipping services, the Group’s assets provide direct access to the significant hinterland of North West England and the main Roll-on/Roll-off (RoRo) services to Ireland. Additionally, the Port of Sheerness provides access to London and Clydeport to Central Scotland. Great Yarmouth, as an offshore supply base, is strategically located close to the oil, gas and windfarm installations in the Southern North Sea.

In addition to providing landlord services to the many leading businesses that operate from the Group’s port facilities, the Group also offers a value-added logistics solution to a customer’s supply chain. This includes conservancy, pilotage, berthing, facilities rental, storage, cargo handling and shipping.

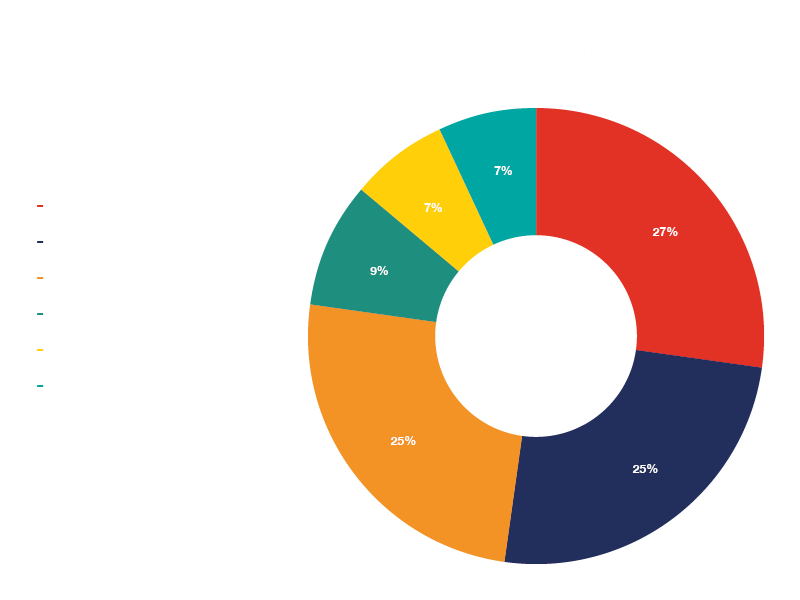

The Group handles a diverse range of cargos including bulk liquids, bulk solids, automotive, energy, agribulks and containers.

The Group’s container handling offering is centred on the Port of Liverpool, which operates two container terminals, Liverpool2 and the Royal Seaforth Container Terminal (“RSCT”).

Liverpool2 is a new in-river deep-water container terminal capable of accommodating the world’s largest container vessels with smaller post-Panamax vessels the most likely primary users of the terminal.

The terminal is being constructed in two phases. The first phase of the construction of Liverpool2 saw approximately £300m invested, in addition to further investment in the port infrastructure at Liverpool. This was part financed by a £150m loan secured from the European Investment Bank and a Regional Growth Fund grant of £35m.

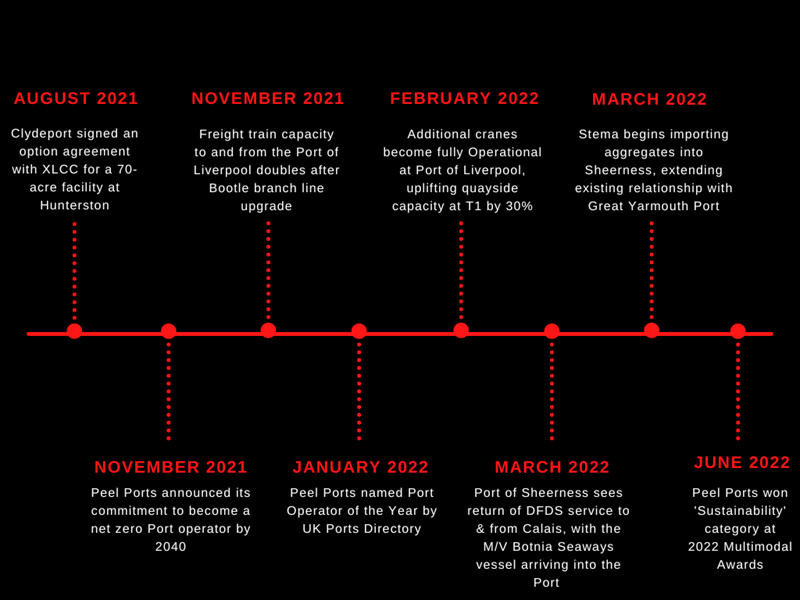

The second and final phase of the construction was completed in the year ended 31 March 2022; this further increased the capacity of Liverpool2 and in the main, represented investment in additional quayside and landside cranes.

In January 2020, the Group entered into a joint venture agreement with Terminal Investment Limited S.A.R.L. in respect of the cargo handling operations of the Liverpool2 deep-water container terminal at the Port of Liverpool.

RSCT was the Port of Liverpool’s existing container terminal. It has direct deep-sea and short-sea connections to a range of countries, including the USA, Canada, Spain, Italy, Portugal, Israel, Cyprus and Turkey, in addition to a number of feeder services connecting Liverpool with the Far East, India, Africa and South America.

The Group’s two main terminals in Liverpool are complemented by facilities at Greenock in Scotland and Dublin in Ireland.

The combination of the Liverpool2 terminal with the Group’s existing port assets and short sea shipping services in the Irish Sea and the Continent is expected to provide significant advantages to shipping lines, importers and exporters. It is estimated, for example, that 35 million consumers live within a radius of 150 miles of the Port of Liverpool.

Shipping

The Group’s port operations are complemented by a shipping line, providing short sea container services between the UK, Ireland and mainland Europe and feeder services between the UK and Ireland. Operating as BG Freight Line, based in Rotterdam, the segment took delivery of four new purpose-built vessels in 2018 designed specifically to meet the needs of customers. In addition to these seven-year charters, the segment also charters other vessels on a short-term basis as required to meet demand.

Financial Review

Year ended 31 March 2022

A summary of some of the notable milestones in the year ended 31 March 2022 and beyond is shown below:

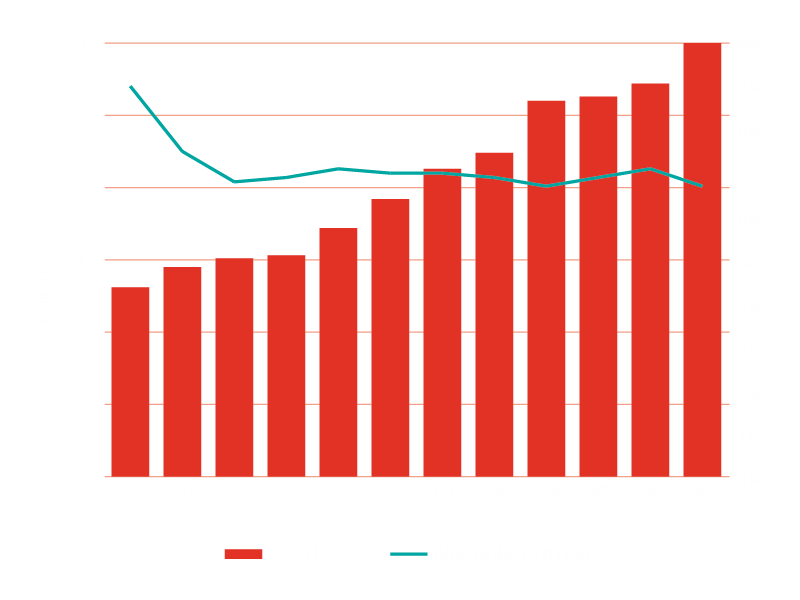

In FY22, Peel Ports Group reported revenues from continuing operations of £618m (2021: £505m) and EBITDA of £300m (2021: £275m). The Group’s EBITDA has increased annually for the last 10 years, including during the latest general economic downturn caused by the outbreak of COVID-19, demonstrating its resilience in challenging times.

In the year ended 31 March 2022, net investment in capital expenditure totalled £122.8m (2021: £124.9m). This included further investment in Liverpool2 to increase the terminal’s capacity and construction of new warehouses. Investment in border control infrastructure has also been made at each of the Group’s principal ports. The Group has also continued to invest in a business-wide ERP system. Maintenance projects in the year included the installation of new lock gates at Alfred Inner Gates and the refurbishment of the grain terminal at the Port of Liverpool and replacement of QE2 outer caisson gate at the Manchester Ship Canal.

Capital & Funding Structure

Equity Investors

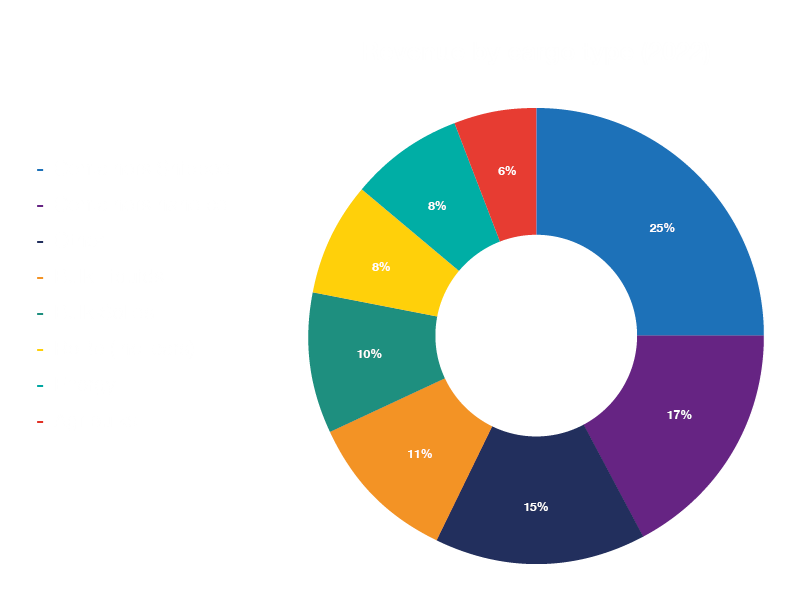

The shareholders of Peel Ports are Peel Group (37.6%), AustralianSuper (32.4%), and Lemon 2021 Ltd, an entity owned jointly by APG and Global Infrastructure Partners (30%).

Finance Investors

In December 2012, the Group established its investment grade secured corporate debt programme, which was structured to enable access on a pari passu basis to bank debt, public bonds and private placement notes. The facilities were provided by an international banking syndicate and institutional investors in the US private placement market. Since December 2012, the Group has refinanced bank debt in excess of £1bn, as well as raising additional debt to support continued investment in the Group’s infrastructure.

Corporate Structure

The Peel Group is a leading investor in infrastructure, transportation and real-estate in the UK, with collective investments and assets under management of more than £5 billion.

AustralianSuper manages more than AUD$233 billion (June 2021) of members' retirement savings on behalf of more than 2.4 million members from around 360,000 businesses*. One in 10 working Australians is a member of AustralianSuper, Australia’s largest and best performing super fund over the long term.

APG is the largest pension provider in the Netherlands. It manages approximately €617 billion (October 2021) in pension assets for the pension funds in these sectors. APG works for approximately 22,000 employers, providing the pension for one in five families in the Netherlands (about 4.7 million participants). APG has been an active infrastructure investor since 2004, investing approximately €20 billion to date and over €8 billion in the Transport.

Established in 2006, Global Infrastructure Partners (GIP) is one of the world's leading specialist infrastructure investors. GIP make equity and debt investments in infrastructure assets and businesses in both OECD and selected emerging market countries, targeting investments in the energy, transport, water / waste and digital infrastructure sectorS. GIP manages over US$79 billion for its investors. Its funds own 40 current portfolio companies which have combined annual revenues of c. US$34 billion and employ in excess of 58,000 people.

The businesses operate through the following corporate structure: